8 Easy Facts About Personal Loans Canada Explained

8 Easy Facts About Personal Loans Canada Explained

Blog Article

Some Known Factual Statements About Personal Loans Canada

Table of ContentsThe Single Strategy To Use For Personal Loans CanadaSome Ideas on Personal Loans Canada You Need To KnowGetting My Personal Loans Canada To WorkWhat Does Personal Loans Canada Mean?Examine This Report about Personal Loans Canada

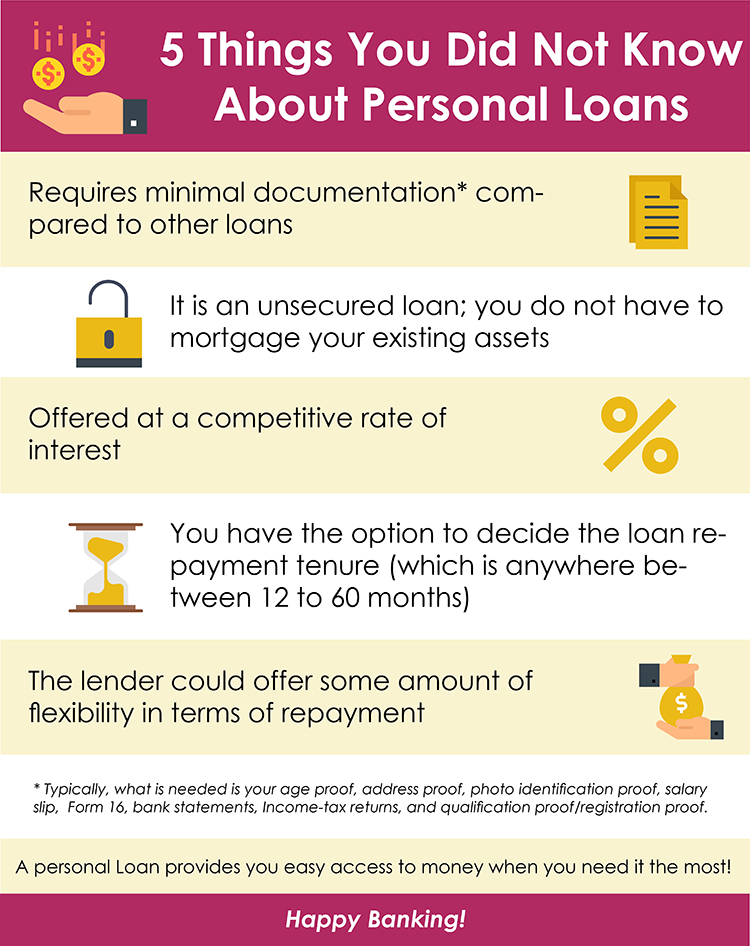

For some loan providers, you can check your qualification for an individual loan using a pre-qualification procedure, which will reveal you what you might get without dinging your credit history. To ensure you never ever miss a lending settlement, consider establishing autopay if your loan provider uses it. In some instances, you might also receive a rates of interest price cut for doing so.This consists of:: You'll require to prove you have a task with a steady revenue so that you can pay back a loan., and other information.

The Main Principles Of Personal Loans Canada

Nevertheless, a reasonable or bad credit rating might limit your alternatives. Individual lendings additionally have a couple of costs that you require to be prepared to pay, consisting of an source cost, which is used to cover the expense of refining your financing. Some lending institutions will certainly allow you pre-qualify for a loan before submitting a real application.

This is not a tough credit rating draw, and your credit report and history aren't influenced. A pre-qualification can aid you extract lending institutions that will not offer you a finance, but not all lending institutions use this choice. You can compare as lots of loan providers as you would certainly such as with pre-qualification, by doing this you only need to finish a real application with the loan provider that's more than likely going to authorize you for a personal loan.

The greater your credit history, the extra likely you are to get the most affordable rate of interest used. The reduced your score, the more difficult it'll be for you to get approved for a finance, and even if you do, you might wind up with a rates of interest on the higher end of what's supplied.

Some Known Factual Statements About Personal Loans Canada

Autopay allows you set it and neglect it so you never ever have to worry concerning missing a financing settlement.

The debtor does not have to report the quantity obtained on the finance when filing taxes. Nevertheless, if the funding is forgiven, it is considered a terminated debt and can be tired. Investopedia commissioned a nationwide survey of 962 united state adults between Aug. 14, official website 2023, to Sept. 15, 2023, that had secured a personal financing to find out how they used their financing earnings and how they might use future individual financings.

Both individual fundings and credit report cards are two alternatives to borrow cash in advance, however they have different purposes. Consider what you require the cash for before you choose your settlement option. There's no wrong selection, but one could be a lot a lot more costly than the other, depending upon your needs.

They aren't for everybody (Personal Loans Canada). If you do not have a co-signer, you may certify for a personal car loan with poor or reasonable debt, however you might not have as numerous choices contrasted to someone with excellent or superb credit history.

Unknown Facts About Personal Loans Canada

A credit report of 760 and up (outstanding) is most likely to get you the most affordable rate of interest readily available for your lending. Debtors with credit rating scores of 560 or below are more probable to have trouble getting approved for better loan terms. That's due to the fact that with a lower credit report, the rate of interest often tends to be too high to make a personal financing a viable borrowing choice.

Some elements carry even more weight than others. As an example, 35% top article of a FICO rating (the kind made use of by 90% of the lenders in the nation) is based upon your settlement background. Lenders wish to make certain you can manage fundings properly and will certainly look at your past behavior to get a concept of exactly how responsible you'll be in the future.

In order to maintain that portion of your rating high, make all your payments promptly. Being available in second is the quantity of charge card debt impressive, about your credit limitations. That makes up 30% of your credit report and is understood in the sector as the credit report usage ratio.

The lower that proportion the better. The size of your credit rating, the type of credit report you have and the variety of go to these guys new credit scores applications you have just recently filled up out are the various other factors that establish your credit report. Beyond your credit history, lenders check out your earnings, work history, fluid assets and the amount of overall debt you have.

The Buzz on Personal Loans Canada

The higher your income and possessions and the reduced your various other debt, the better you search in their eyes. Having a good credit report when requesting an individual loan is essential. It not only determines if you'll obtain authorized yet how much passion you'll pay over the life of the lending.

Report this page